“Double Digit Growth” (DDG) is de rigueur, particularly the “double digit” part. However, it may still not be enough. If you invest in stocks, you’ll learn that anything less than double digit growth of revenue, or expectation for such is unacceptable. At least, that’s what the markets tell you. Anything less than DDG and, typically, the stock is being pummeled severely.

Not that long ago, the populations of many countries grew at double digit rates of growth, along with their government budgets, debts, and everything else as well. With that, seemingly never ending DDG, many authorities decided to “borrow against the future”. After all, the debt incurred would easily be repaid by the (expected) future population and economic growth.

Population Dynamics

Alas, there has come to be a fly in the ointment. Over recent decades, much of the western world has now experienced much less than DDG. In fact, even population replenishment by births is negative in many European countries, in North America, and other parts of the world. For example, Canada, USA, Germany, France, Britain, to name a few, have birth rates of well below the 2.1/female adult or so, that is required just to maintain the population.

By itself, a stable, and even a declining population would not be any problem. However, all actuarial models used throughout most of the 20th century and right up to now, were predicated upon steady growth (and often DDG) in nearly everything , such as population, energy consumption, vehicles for transport, leisure time, etc. Obviously, limits to rates of growth had to or will be reached sometime, whether state enforced (e.g. the “one child” policy in China), or by limited natural and financial resources, or simply voluntarily.

Growth at all costs

The current economic malaise of much of the world is really nothing but a natural response to the enthusiastic, but unsustainable DDG seen in previous decades. If and where necessary (to maintain DDG, at least on paper), governments of all stripes, from small villages to entire countries pursued policies of borrowing from the future, i.e. were incurring vast amounts of debt – to be paid back in the future from the expected DDG-based increases in revenues. None wanted to be left behind; everyone borrowed to the hilt.

The tide is turning

But now, the tide has turned. DDG is no longer the case, but the debts have not gone away; in fact, they are larger than ever, when measured as a percentage of revenue. This has put many jurisdictions under severe economic strains, some even into default position. They can no longer pay the current expenditures and interest on past debts (despite the current, historically low interest rates). So, rather than curtailing their spend-thrift ways of the past, these entities now feel that they are forced to “beg, borrow, or steal” even more. New taxes, novel user fees, fuel surcharges, and similar means of enhancing revenues are being invented and charged all over.

Outlook

Unfortunately, it is all to no avail. Much of the western world is too deep in hock already to ever be able to dig itself out of these holes. On average many North American, European, and Asian countries all have debt to GDP ratios in the order of 100%. While those with (still) strongly expanding populations may be able to (at least partially) grow their economies out of the accumulated mountain of debt, most of them will not. Eventually, the lenders of the borrowed funds will stop extending their lending at rates at or below inflation.

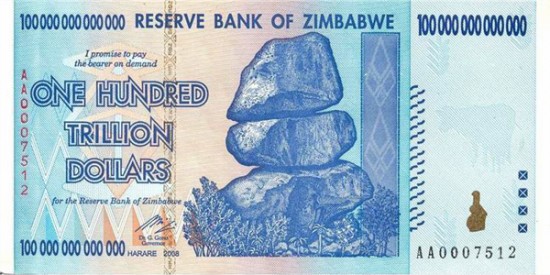

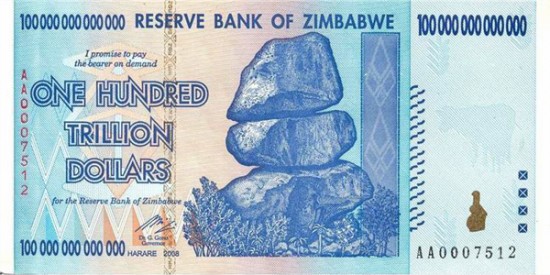

Massive inflation or straight forward defaults are the only viable solutions. In either case, the end of many of today’s paper- and promise-to repay-based currencies is near. The most recent example has been Zimbabwe, where rampant inflation caused a complete collapse of the currency (see picture of a Zimbabwe 100 TRILLION dollar bill.)

History has shown numerous such examples over the past century alone. Despite all the good intentions pronounced by leading politicians, ever-lasting DDG, and the idea of growing economies out of debt forever, is simply a mirage.

In the entire western world, the money-printing presses are running full tilt. Eventually though, it will end all end in a financial catastrophe. The purchasing power of most (promise-based) currencies will simply be wiped out.

I feel bad for my new granddaughter, scheduled to arrive soon.

History has shown numerous such examples over the past century alone. Despite all the good intentions pronounced by leading politicians, ever-lasting DDG, and the idea of growing economies out of debt forever, is simply a mirage.

In the entire western world, the money-printing presses are running full tilt. Eventually though, it will end all end in a financial catastrophe. The purchasing power of most (promise-based) currencies will simply be wiped out.

I feel bad for my new granddaughter, scheduled to arrive soon.

History has shown numerous such examples over the past century alone. Despite all the good intentions pronounced by leading politicians, ever-lasting DDG, and the idea of growing economies out of debt forever, is simply a mirage.

In the entire western world, the money-printing presses are running full tilt. Eventually though, it will end all end in a financial catastrophe. The purchasing power of most (promise-based) currencies will simply be wiped out.

I feel bad for my new granddaughter, scheduled to arrive soon.