Oil production in the United States is increasing led by states such as Texas and North Dakota. The oil production increases in Texas and North Dakota are driven by shale oil and if some analysts from Citi are to be believed, these increases are just the beginning. They believe that total petroleum liquids production could double in the next 8 years in large part because of shale plays on private and state lands.

Oil Production in the States

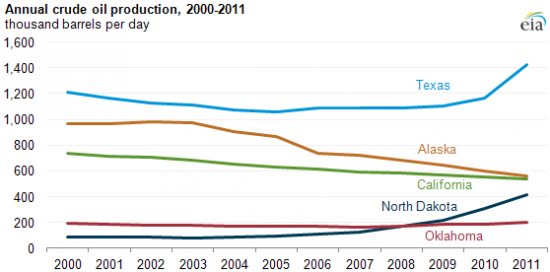

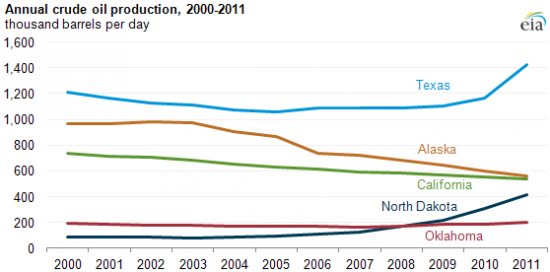

In 2011 oil production in Texas and North Dakota dramatically increased. According to the Energy Information Administration these big production gains (see chart below) were mainly the result of increased horizontal drilling and hydraulic fracturing. The top five oil producing states (Texas, Alaska, California, North Dakota, and Oklahoma) accounted for

56 percent of U.S. oil production in 2011.

[ia]

Source:

Source: U.S. Energy Information Administration,

Petroleum Supply Monthly.

Note: Production data includes crude oil and lease condensate.

Texas produced

1,427 thousand barrels per day in 2011, 22 percent more than in 2010 and the highest amount of oil production since 1997. This increase is primarily from the Eagle Ford shale formation in south Texas.

[ii]

Alaska produced 563 thousand barrels per day in 2011, 6 percent less than in 2010. Oil production in Alaska has now fallen for the ninth year in a row. Alaska oil production is getting dangerously low for operation of the

Trans Alaskan Pipeline System (TAPS), which was built to transport 2.1 million barrels per day. Some experts have estimated that flows down to 200 to 300 thousand barrels per day would be the minimum for viability. But even levels below 600 thousand barrels per day require modifications to make the pipeline economically viable to maintain oil production. The federal government could expedite opening the Naval Petroleum Reserve-Alaska (NPRA) or the Arctic National Wildlife Refuge (ANWR) to oil exploration to keep TAPS flowing, but both are federal properties and need Government approval. Offshore federal production could also contribute domestic oil to the pipeline, but access to these supplies has been severely limited by government actions and appeals and lawsuits by environmental pressure groups. While the NPRA is technically open for drilling, oil production there is in need of an oil pipeline that must be approved by the Army Corps of Engineers to move the oil to the Trans Alaskan Pipeline. ANWR needs Congressional approval before drilling can occur on its 10.4 billion barrels of technically recoverable oil

[iii] and the Obama Administration opposes opening ANWR.

California produced 538 thousand barrels per day in 2011, 3 percent less than in 2010. This is the lowest level of oil production in at least three decades. Drilling off the Atlantic and Pacific coasts, though now allowed with the lifting of the OCS moratorium in 2008, is not in the Department of Interior's next five year lease plan.

North Dakota produced 419 thousand barrels per day in 2011, 35 percent more than in 2010. In December 2011, North Dakota produced

535 thousand barrels per day, more oil than California produced, making North Dakota the third largest oil producer for that month. North Dakota's oil production increases are due to hydraulic fracturing and horizontal drilling at the Bakken shale oil formation.

Oklahoma produced 204 thousand barrels per day in 2011, 7 percent more than in 2010, and the highest level since 1998.

Onshore production, which is mostly on private and state lands, is thriving. According to the Energy Information Administration, onshore oil production increased

10 percent in 2011while offshore oil production, which is mostly on federal lands, declined by 10 percent. The decline in offshore oil production was due to the moratorium and the de facto moratorium on drilling that the Obama Administration imposed after the oil spill accident in the Gulf of Mexico. In fact, according to Department of Interior data, offshore oil production on federal lands in fiscal year 2011 declined by

17 percent from the prior fiscal year.

[iv]

Forecasts of Future Oil Production

The International Energy Agency (IEA) projects that North America will be the fastest growing oil-producing region outside of OPEC over the next five years. IEA expects oil output in North America to increase

11 percent due to production from oil sands in Canada and shale formations in the United States, with oil production in the United States reaching 8.3 million barrels per day by 2016.

[v]

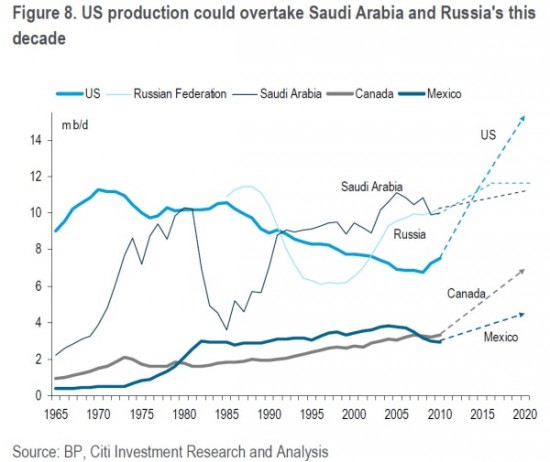

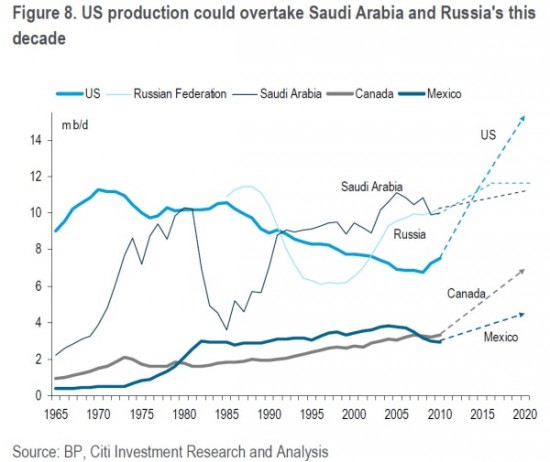

Citi analysts believe that oil and gas production in North America will skyrocket in the next 8 years. They expect total liquids production in North America to double, with the United States overtaking both Russia and Saudi Arabia in oil production by 2020. Due to the increased energy production

, 3.6 million new jobs would be created by 2020. Of those new jobs, about 600,000 would be in oil and gas production and 1.1 million would be in related industrial and manufacturing sectors. Unemployment is expected to decline by up to 1.1 percent and real GDP is expected to increase by 2.0 to 3.3 percent.

[vi]

The only

caveat is an important one for government officials and Members of Congress:

"Whether the increase in production results in the US reducing its imports or whether net exports grow doesn't matter much to world balances. Either way, North America is becoming the new Middle East. The only thing that can stop this is politics--environmentalists getting the upper hand over supply in the U.S., for instance; or First Nations impeding pipeline expansion in Canada; or Mexican production continuing to trip over the Mexican Constitution, impeding foreign investment or technology transfers--in North America itself."

[vii]

Conclusion

Technology is at the forefront of oil production expansion in North America with hydraulic fracturing and horizontal drilling extracting oil from shale formations in the United States and mostly in-situ techniques for producing oil from oil sands in Canada. Forecasters see North America as the fastest growing source of increased oil production outside of OPEC for the remainder of this decade, bringing jobs and economic prosperity to North America. But data show that the production increases seen in 2011 were primarily on state and private lands. Just think how much more could be achieved if the federal government would allow more onshore and offshore federal lands to be available for oil production.

[ia] Energy Information Administration,

Five states accounted for about 56% of total U.S. crude oil production in 2011, March 14, 2012

[ii] Energy Information Administration,

Crude Oil Production

[iii] Institute for Energy Research,

U.S. Government Shuts Out Increased Alaskan Oil Production, February 23, 2011

[iv] Energy Information Administration,

Sales of Fossil Fuels Produced from Federal and Indian Lands, FY 2003-FY2011, March 2012

[v] Bloomberg,

IEA says North American Oil Output Growth Strongest Outside of OPEC, June 16, 2011

[vi] Business Insider,

CITI: The US Energy Industry Is Going To Grow So Fast, It Will Spark A New 'Industrial Revolution', March 21, 2012

b>[vii] Citi GPS,

Energy 2020 North America, the New Middle East?, March 20, 2012

Source: U.S. Energy Information Administration, Petroleum Supply Monthly.

Source: U.S. Energy Information Administration, Petroleum Supply Monthly. The only caveat is an important one for government officials and Members of Congress:

"Whether the increase in production results in the US reducing its imports or whether net exports grow doesn't matter much to world balances. Either way, North America is becoming the new Middle East. The only thing that can stop this is politics--environmentalists getting the upper hand over supply in the U.S., for instance; or First Nations impeding pipeline expansion in Canada; or Mexican production continuing to trip over the Mexican Constitution, impeding foreign investment or technology transfers--in North America itself."[vii]

The only caveat is an important one for government officials and Members of Congress:

"Whether the increase in production results in the US reducing its imports or whether net exports grow doesn't matter much to world balances. Either way, North America is becoming the new Middle East. The only thing that can stop this is politics--environmentalists getting the upper hand over supply in the U.S., for instance; or First Nations impeding pipeline expansion in Canada; or Mexican production continuing to trip over the Mexican Constitution, impeding foreign investment or technology transfers--in North America itself."[vii]